LogiChem EU 2026

24 - 25 March 2026

de Doelen ICC Rotterdam

Release The Value Locked Up In Your Supply Chain

How logistics planners in oil and gas hold the keys to optimization and efficiency

A survey of 100 senior executives in oil and gas by WBR Insights and Quintiq

Table of Contents

- Executive Summary

- Removing the barriers to optimized logistics planning

- Four key findings in-depth

-

- A feasible plan is necessary, but is it sufficient?

- There are hidden opportunities in multimodal logistics planning

- The optimal solution is only one scenario amongst many

- The next step: Optimized logistics planning

- Summary: ready to unlock the value in your supply chain?

- About the survey and respondents

- About Quintiq

Executive Summary

The low price of oil has increased pressure to find savings from the bottom line in oil and gas companies. This begs the question: how much money is being left on the table every day due to suboptimal logistics planning?

Every oil and gas company is unique, and with each company comes a unique logistics puzzle. While some companies may be content to manage their logistics planning with a 20 year old excel spreadsheet from an unknown author, the chances are that they are missing out on potential savings by not looking deeper at the possibilities. In fact, the more complicated the puzzle, the bigger the opportunity for cost-efficiencies.

Our research shows that there a number of areas in which oil and gas companies may be losing out due to suboptimal logistics planning:

- Some companies still rely on basic tools to inform their decision making

- Planners rarely evaluate multiple scenarios in detail

- Decision-making support rarely offers the opportunity to include key diagnostic data

- Planning and optimization is a big priority for the future

As oil and gas companies turn to all areas of the business to deliver efficiency based savings, logistics planners have an opportunity to contribute significantly.

Key Findings

Removing the barriers to optimized logistics planning

Interview with Dennis Ostendorf, Quintiq

How much of a problem is suboptimal logistics planning for oil and gas companies?

What we’ve seen in recent years with the new reality of lower oil prices and increased concern regarding emissions is that the margins have really dropped. This makes it crucial to optimize the entire oil and gas value chain. Both within and outside the oil and gas industry, we’ve seen that cost reductions of up to 20% can be achieved with logistics optimization alone. In a recent webinar, my colleague Ian Tootell calculated that this translates to $43 million every day, just for the upstream oil and gas industry!

What are some of the most common roadblocks you commonly see in the planning process? The biggest challenge in optimization is that you need to get it just right, otherwise it won’t add value. What I mean

is that every company is unique – even companies that look very similar on the outside are actually quite different when you take a closer look at the details. Take a look at inventory as an example. In general, there are clear rules around inventory levels – it needs to be maintained between certain acceptable levels. But what if your specific company can be flexible in that? For instance, you are able to acquire additional temporary inventory so your tank top limit is less rigid than may be typical in the industry. If your optimization solution fails to include this specific rule, then you leave a lot of value on the table. Still, this is only a case of missed opportunity. An even worse scenario occurs when you don’t fully capture a specific business rule – this means your plans are actually not executable at all and the team has to constantly find workarounds.

Where is the biggest opportunity to add value to the business in terms of improving planning systems and procedures?

In the past, logistics optimization hasn’t been much of a focus for oil and gas companies. A lot of optimization effort has been put into maximising production, especially

in maximizing the efficiency of refineries. As long as there were high margins, this worked fine. Now with the continued emphasis on reducing costs across the value chain, we see a huge amount of potential in logistics planning where we encounter a lot of legacy systems and spreadsheets that are ripe for an upgrade.

What are the most innovative companies doing in terms of logistics planning that others can learn from?

Historically speaking, companies – especially within oil and gas – have been fragmented. They have a tendency to work in silos: one group is responsible for extraction, another for refinery planning, and yet another group for primary or secondary distribution. There is nothing wrong with this segmentation per se, provided that all these silos integrate well with each other. So instead of everyone optimising their own specific segments, an integrated planning solution allows for optimization across the board. Hence, the greatest value comes from an integrated approach across the supply chain.

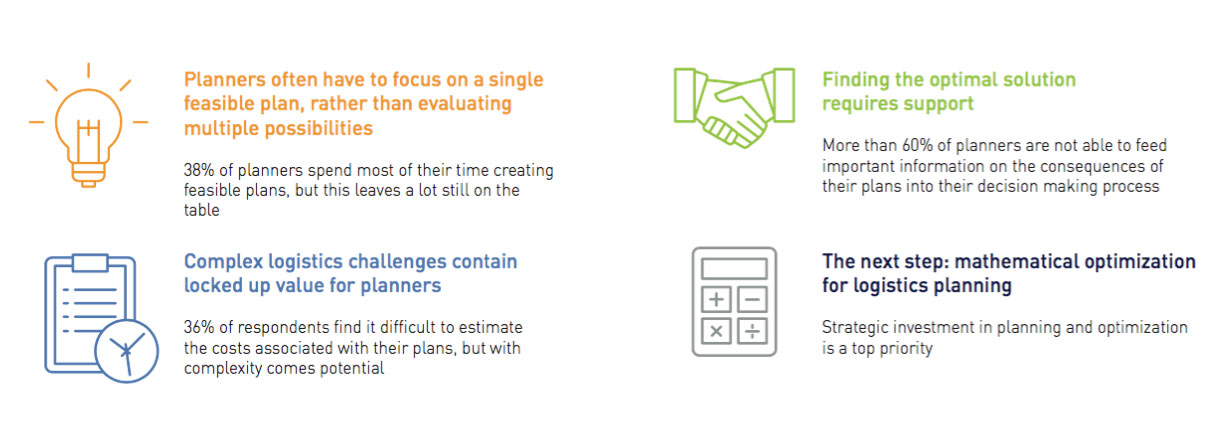

1. Planners often have to focus on a single feasible plan, rather than evaluating multiple possibilities

Analysis

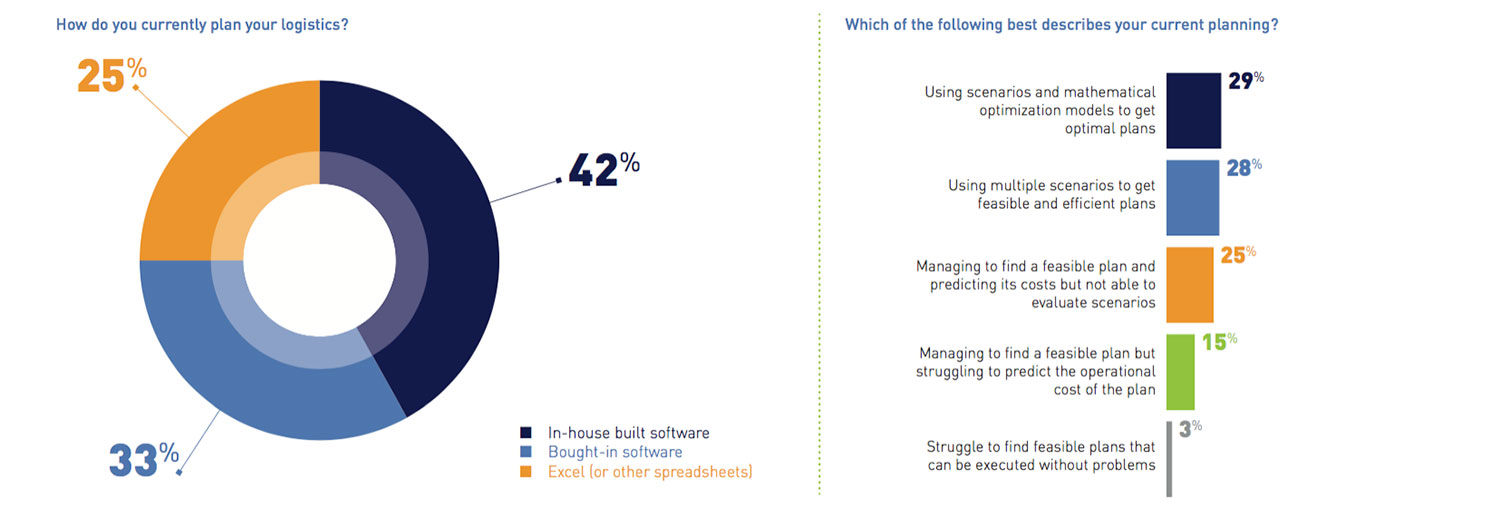

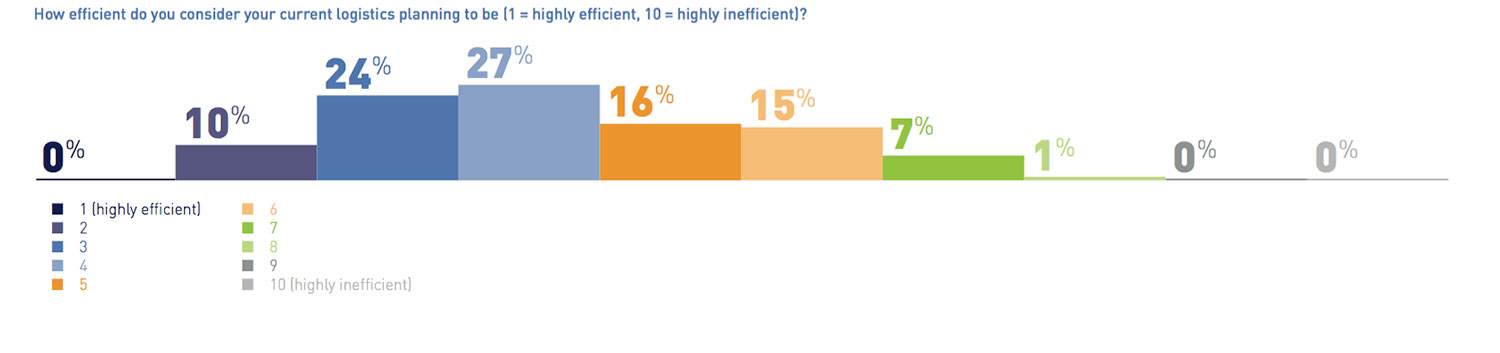

It’s no secret that logistics planning can take a long time – but are your planners using their time in a way that maximises the benefit to the business? Our research suggests there is plenty of value left locked up in outdated processes or legacy systems. In fact, when we asked our respondents to rate the efficiency of the current logistics planning on a scale of 1 to 10, with 1 being highly efficient, the average response was only 4.2.

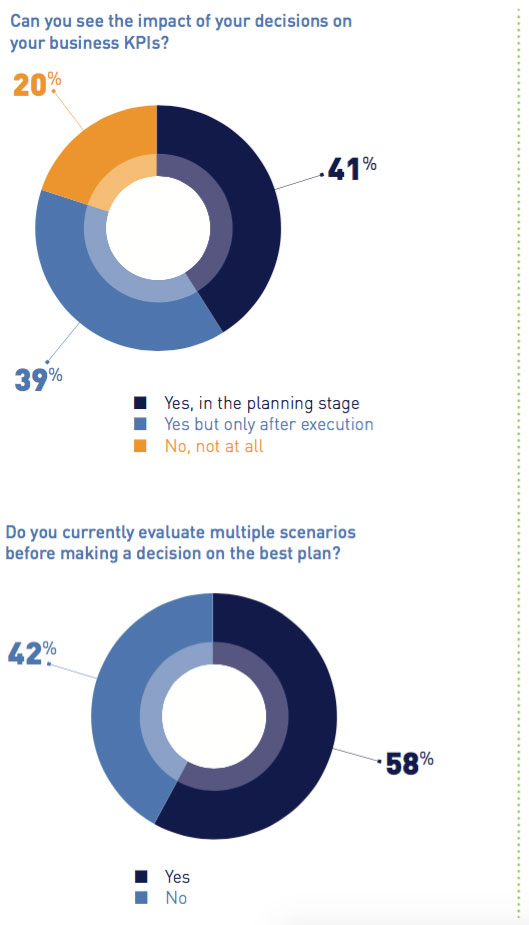

Our research also revealed that as many as 38% of planners spend almost their entire day creating a feasible operational plan, but struggle to know what the costs of this plan are, or evaluate potential alternatives. Of course, every business is unique, and for oil and gas companies no logistics puzzle is ever quite the same. As such, the tools that planners use will play a huge role in their ability to measure the impact of their decisions.

This planning infrastructure is often built up organically over a long period of time, and depending on the complexity of the puzzle a simple off the shelf solution or series of excel spreadsheets may be enough. However, if you are looking at a logistics puzzle that is either very large, very complex or both, then the systems you are using leave a lot of the value on the table, and there is huge opportunity in an optimal solution.

Making your plan feasible is the number one priory, of course, but if you have all of the information available, and you have a tool that makes it easier to create plans using decision support and optimization technology then your planners will be able to use their knowledge and skills to evaluate the alternatives to come up with the optimal plan, not just a feasible one.

Data:

2. Complex logistics challenges contain locked up value

Analysis

To say that the puzzles that logistics planners try to solve every day are complex is a colossal understatement – in fact, even simplistic versions of them have many more possible configurations than there are atoms in the universe.

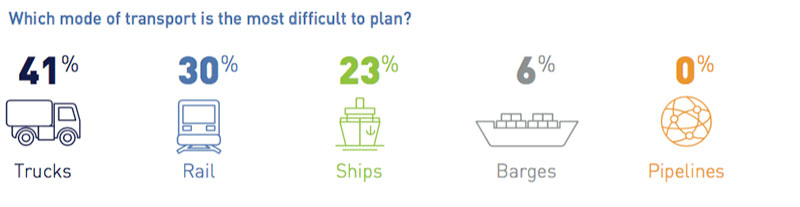

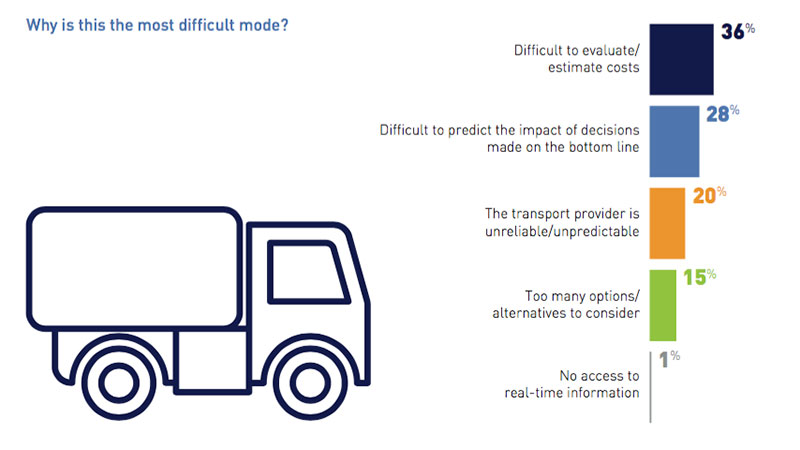

The different modes of transport present different challenges, but our research suggests that trucks present the biggest challenge of all – More than 40% of respondents agreed that they are the most difficult mode to plan.

These results are not entirely surprising as trucks present a number of challenges which are either unique to them, or are exaggerated in comparison with other modes. From fairly simple things like loading regulations, road laws, and maintenance, to more complex ones, like deciding when and how much fuel to deliver at a time. There is also the fact that fleets of road vehicles can easily number in the hundreds and turn their loads around much faster than ships or trains.

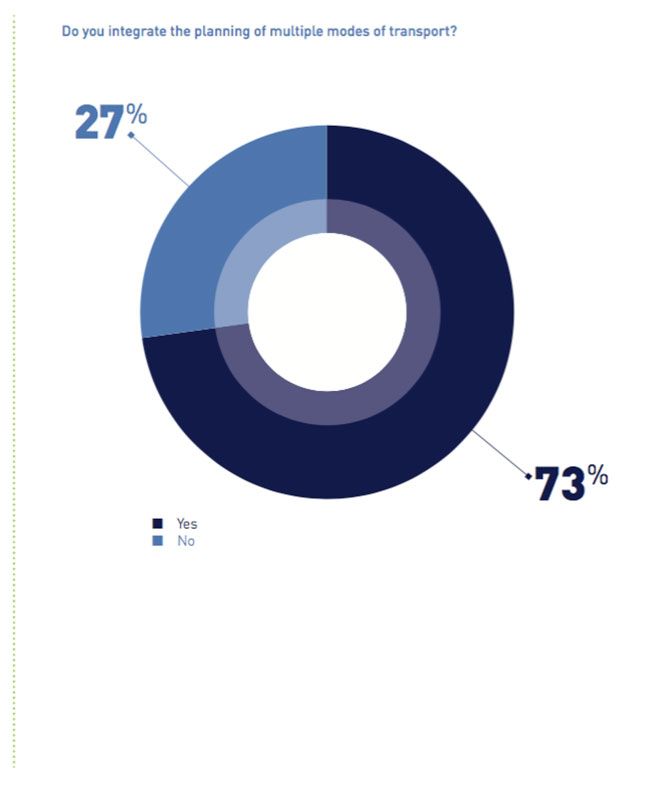

Our research also told us that 27% of logistics planners are not currently taking multiple modes of transport into account when making their plans. This might be the result of a process which has grown organically over time, like if a global planning department is making the decisions, and then the local pipeline and rail planning departments don’t talk to each other.

All of this complexity adds up to a huge opportunity for optimization, but it also makes your puzzle all the more complicated and unique.

Data:

3. Finding the optimal solution requires support

Analysis

When planners expend all of their energy on creating a feasible plan, they may be leaving money on the table in the form of optimization.

More than 60% of planners are not able to feed important information on the consequences of their plans into their decision making process, and this could be seriously inhibiting their ability to unlock that value. If when you create your plan for tomorrow you can see the effect of your plans on your utilisation, then you can still act on it.

Of course, to do this effectively you will need to have the capacity to evaluate different possible scenarios – something more than 40% of the planners we spoke to do not currently do. Let’s think about seafaring vessels, for example. There are plenty of variables to take into account, and you need to be able to make practical decisions about which route you want your ship to take, the fees involved, where they need to refuel, or the availability of ships for future shipments.

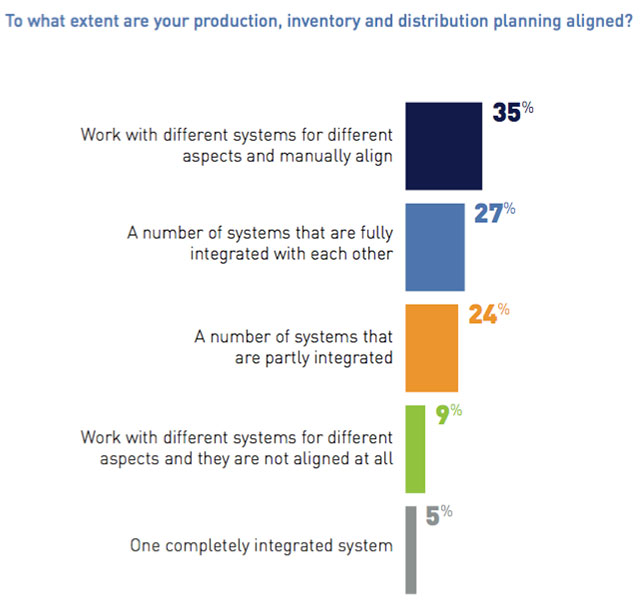

As we can see from the data, only 5% of businesses are currently using one integrated planning system. And while this kind of solution may not make sense for every business, it is clear that many companies are leaving money on the the table.

All of these variables add up to a lot of complexity, and for the optimization-minded logistics planner, complexity means opportunity. It should be for planners to experiment with different possibilities – and be able to immediately determine if this is a good decision or not – and whether that change should be adopted into the plan.

It’s also important since business KPIs can often be somewhat in competition with each other. Yes, making a certain decision may help you save money, but will there be a negative impact on customer satisfaction? Or might the change result in additional costs in another area of the business?

For planners, this is the first necessary stage to a more complete decision making support process, but it is also only a step toward the next level of maturity: optimization.

Data:

4. The next step: mathematical optimization for logistics planning

Analysis

The next level is advanced optimization – moving on from simply evaluating a few different scenarios to doing something more advanced like simulating a number of different real world possibilities, and doing comparisons with the previous plan.

Using this kind of framework to support decision-making means that the planners can take account of the relevant KPI priorities, constraints, and laws – entering them into the system as part of their mathematically optimized plan.

Of course, that is not to say that the automatically generated plans will be ready to implement from an operational viewpoint. Automated plans enable a planner to use their experience and knowledge to tweak plans to ensure the final plan is the optimal one for the business. Optimization software enables planners to focus on adding value rather than just spending time to find a feasible plan.

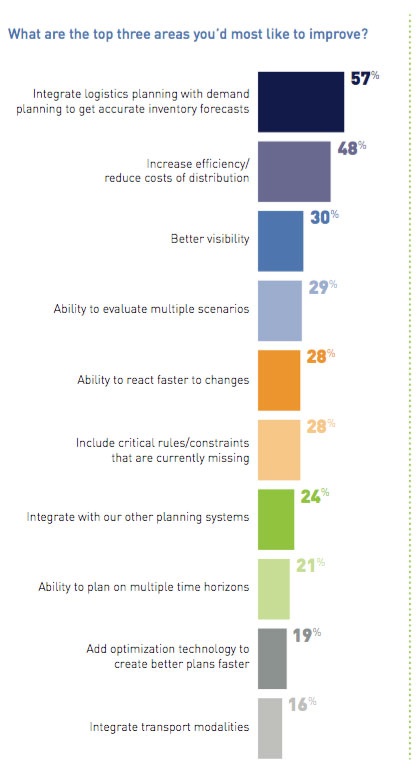

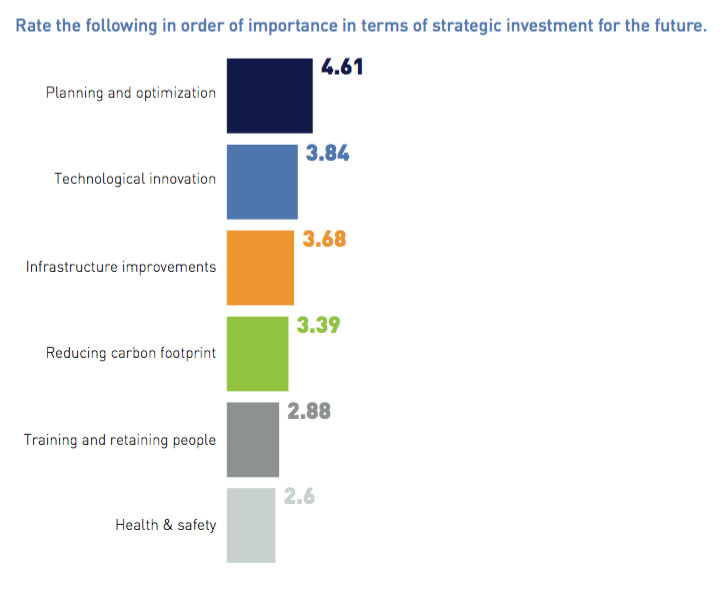

When we compare these desires with how they reflect on strategic investment we can see that our respondents have a clear desire to improve efficiency by investing in improvements to planning and optimization – more than half of respondents rated this as the number one area for strategic investment. Upgrades to technological capabilities are also very important, with 40% of top executives naming this either their first or second priority.

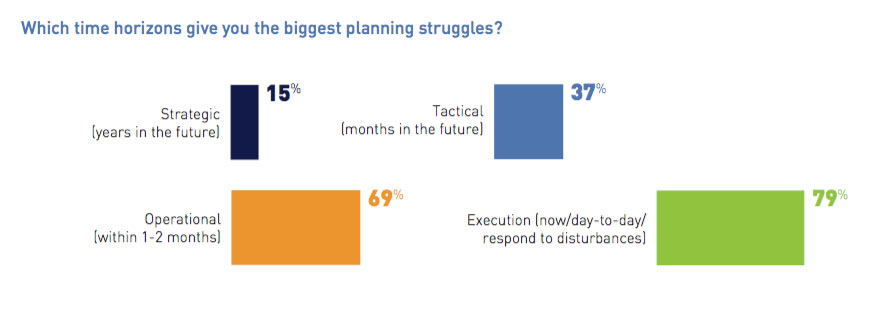

What can look like a great plan on paper can easily go wrong when the day-to-day gets involved and you need to be able to respond, whether it’s because a truck got a flat tire, or because demand forecast is just a little bit off. Things are changing all the time and you need to be able to respond. Being able to see the effect of disruptions, and evaluate alternative scenarios in real time enables planners to make the best decisions for the business.

With short time horizons it’s really all about minimizing loss rather than making the big savings. Optimization software provides planners with the optimal solutions, enabling them to make the best decision for the business. Being able to see the effects of planning decisions in real-time gives planners the basis for making the best decision. The further you look into the future, the bigger the decisions you can affect, and the greater the potential for realizing value from the supply chain.

Data:

Summary: ready to unlock the value in the supply chain?

Many organizations have yet to fully unlock the potential of optimized supply chain planning. Planners in these companies often have to focus their energy on producing a plan which is basically feasible, meaning that they don’t have the opportunity to evaluate multiple scenarios and ultimately to devise an optimized plan.

The advantages made in terms of technology have enabled great advances in the support infrastructure that can be offered to oil and gas planners – but with greater responsibility also comes enhanced expectations.

Making sense of all of the data you have, as well as finding a solution which can take into account the unique nature of any individual company can be a real challenge.

The rewards for those who optimize are significant, and the greater the complexity of the puzzle, the greater the potential reward.

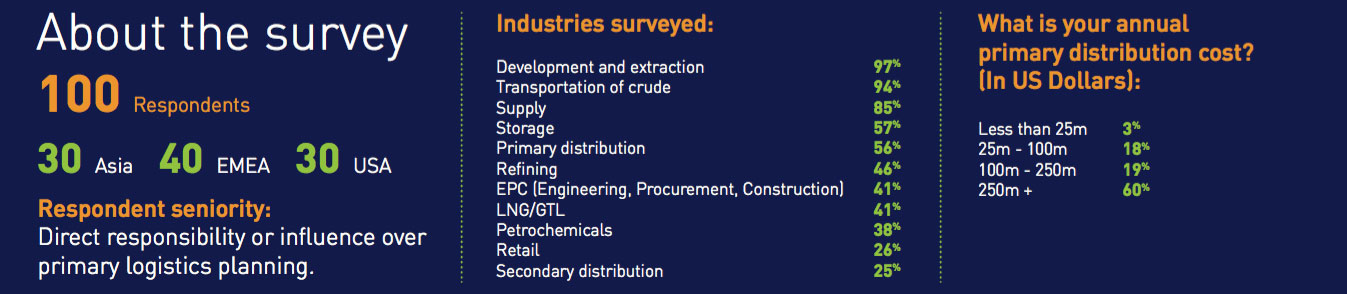

About the survey and respondents

In Q3 of 2017 WBR Insights surveyed 100 senior oil and gas executives from three regions on behalf of Quintiq. The research prioritized multi-national companies based in Europe and the Middle East, the USA, and Asia. Survey respondents were Heads and Directors of Supply Chain and Logistics or others of equal standing. The survey was conducted by appointment over the telephone. The results were compiled and anonymized by WBR Insights and are presented here with analysis and commentary by WBR Insights and Quintiq.

About WBR Insights

At WBR Insights we design and execute bespoke content marketing campaigns, delivering insightful content to our high-level audience all year round.

We are a team of marketers, researchers and writers with a passion for content with a creative twist. From research-based whitepapers focused on your priorities, to benchmarking reports, infographics and webinars, we can help you to inform and educate your readers and reach your marketing goals at the same time.

Contact us to find out how your business could benefit from:

- Year-round access to the wider WBR event database

- Lead generation campaigns that fit your priorities

- In-depth research on current fast-moving issues and future trends

- Promoting your expertise a thought leader in your field

About Quintiq

Every business has its supply chain planning puzzles. Some of those puzzles are large, some are complex and some seem impossible to solve. Since 1997, Quintiq has been solving each of those puzzles using a single supply chain planning and optimization software.

Quintiq is part of Dassault Systèmes (Euronext Paris: #13065, DSY.PA) and has headquarters in the Netherlands and the USA, and offices around the world.

Quintiq is fully integrated with Dassault Systèmes 3DEXPERIENCE platform to provide customers with a comprehensive environment to model, simulate and optimize their business operations end to end, from setting strategic goals to achieving new levels of innovation, operational efficiency and performance.

Consistently rated as market leader by the world’s most influential industry analysts, Quintiq capabilities go beyond supply chain to encompass full operations planning and optimization. Its solutions are used to plan and schedule complex production supply chains; optimize intricate logistics operations, and plan and schedule large, geographically diverse workforces.

For more information, visit quintiq.com.